vermont sales tax on alcohol

Alcoholic Beverage Sales Tax. 0183 per gallon.

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

100 on sales of alcoholic beverages served in restaurants.

. In Wyoming and New Hampshire all wine and spirits must be bought at government monopoly stores. Liquefied Natural Gas LNG 0243 per gallon. 90 on sales of prepared and restaurant meals.

Certain Municipalities may also impose a local option tax on meals and rooms. Vermont Alcoholic Beverage Sales Tax 87238 KB File Format. Vermont Use Tax is imposed on the buyer at the same rate as the sales tax.

All hard liquor stores in Vermont are state-owned so excise taxes for hard alcohol sales are set by the Distilled Spirits Council of the United States DISCUS. Vermont has a statewide sales tax rate of 6 which has been in place since 1969. 2018 No significant enactments 2017 Delaware.

However for sparkling wine the rate is 30 cents. Vermont state sales tax. Counties and cities in Vermont are allowed to charge an additional local sales tax on top of the Vermont state sales tax with 10 cities charging the additional 1 local sales tax.

The Division of Liquor Control contributes millions each year to the states general fund in the form of excise and sales taxes. IN-111 Vermont Income Tax Return. In Vermont wine vendors are responsible for paying a state excise tax of 055 per gallon plus Federal excise taxes for all wine sold.

The Vermont excise tax on liquor is 768 per gallon higher then 70 of the other 50 states. This is because spirits have higher alcohol content than the other categories. PA-1 Special Power of Attorney.

The state of Vermont does not usually collect sales taxes on the vast majority of services performed. The Vermont Division of Liquor Control DLC was created in 1933 when the 21st Amendment to the US. Apr 01 2021 The state sales tax rate in Vermont is 6000.

See definition at 32 VSA. Constitution repealed the Volstead Act Prohibition. The sales and use tax is also imposed on many of the items purchased and used by businesses although some items are exempt from tax.

Colorados cannabis taxes are levied at higher rates per serving a 5-milligram edible might incur around 16 cents of state tax for example and raised 396 million. Educates thousands of servers and sellers of alcohol. Tax rates last updated in April 2022.

Alcohol excise taxes in Colorado are 27 cents per shot of liquor 13 cents per glass of wine or 1 cent per pint of beer and raised a combined total of 53 million last year. Effective June 1 1989. The Essex Junction Sales Tax is collected by the merchant on all qualifying sales made within Essex Junction.

This is a tax that towns in Vermont can opt to include bumping the sales tax from six to seven percent on alcohol. Chapter 233 The sales and use tax is imposed on alcoholic beverages sold at retail that are not for immediate consumption. Restaurants are charged at a 9 sales tax rate plus a 1 local sales tax in certain cities and all alcoholic beverages have a 10 sales tax rate plus a 1 local sales tax in certain cities.

For beverages sold by holders of 1st or 3rd class liquor licenses. Tax Rates for Meals Lodging and Alcohol. Sales and Use Tax 32 VSA.

So the combined total is 1680 or 2010. Missouri has a 4225 statewide sales tax rate but also has 731 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 3667 on top of the state tax. Sales and Use Tax Sales of alcoholic beverages by retailers such as grocery stores or convenience stores that are suitable for human consumption and contain one-half of 1 or more of alcohol by volume are subject to the 6 Vermont Sales and Use Tax.

Vermont has a 6 statewide sales tax rate but also has 153 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0156 on top of the state tax. However there are some services which are taxed for example telecommunication services or public utility services involving electricity and gas. Increased the alcoholic beverage tax rates for beer wine and spirits.

The Essex Junction Vermont sales tax is 600 the same as the Vermont state sales tax. Alcoholic Beverage Tax Sales of alcoholic beverages that. Taxes on spirits are significantly higher than beer and wine at 1350 per gallon while beer is taxed at 18 per barrel and wine is 107-340 per gallon.

The statewide rate is 725. Alcoholic Beverage Sales Tax. The tax rate is 6.

Vermont Use Tax is imposed on the buyer at the same rate as the sales tax. Sales tax region name. All alcoholic beverages are subject to the general sales tax.

The Division of Liquor Control is responsible for the sale of spirits and the enforcement of laws and regulations regarding alcohol and tobacco in Vermont. Altered the liquor tax by changing it from a graduated rate to a flat 5 tax. The Office of Education provides education services to licensees bartenders servers store clerks consumers parents teenagers and anyone else who needs to know how to make sure alcohol.

But if the spirit is over 50 alcohol the tax doubles to 660. If you are a new business go to Getting Started with Sales and Use Tax to learn the basics of Vermont Sales and Use Tax. 90 on sales of lodging and meeting rooms in hotels.

The state earns revenue by selling alcoholic beverages so there is no need to apply an additional excise tax on. While many other states allow counties and other localities to collect a local option sales tax Vermont does not permit local sales taxes to be collected. Alcohol used to be exempt but a 6 state sales tax was added to all alcohol and liquor sales in April 2009.

Vermonts general sales tax of 6 does not apply to the purchase of liquor. Modified the states alcohol tax by shifting it from a floor tax to a sales tax for wholesalers. Federal excise tax rates on various motor fuel products are as follows.

Vermonts excise tax on Spirits is ranked 15 out of the 50 states. That includes the local sales tax. For beer and wine the rate is 20 cents per gallon.

W-4VT Employees Withholding Allowance Certificate. Vermont is an Alcoholic beverage control state in which the sale of liquor and spirits are state-controlled. 45 rows The sales tax rate is 6.

The state earns revenue by selling alcoholic beverages so there is no need to apply an additional excise tax on. Liquor sales are only permitted in state alcohol stores also called ABC Stores. Liquor sales are only permitted in state alcohol stores also called ABC Stores.

New State Laws On Sexual Consent Health Care And Alcohol Sales Take Effect July 1 Vtdigger

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Income Tax Vt State Tax Calculator Community Tax

Whistlepig 15 Year Old Straight Rye Whiskey Finished In Vermont Oak 750 Ml Bottle

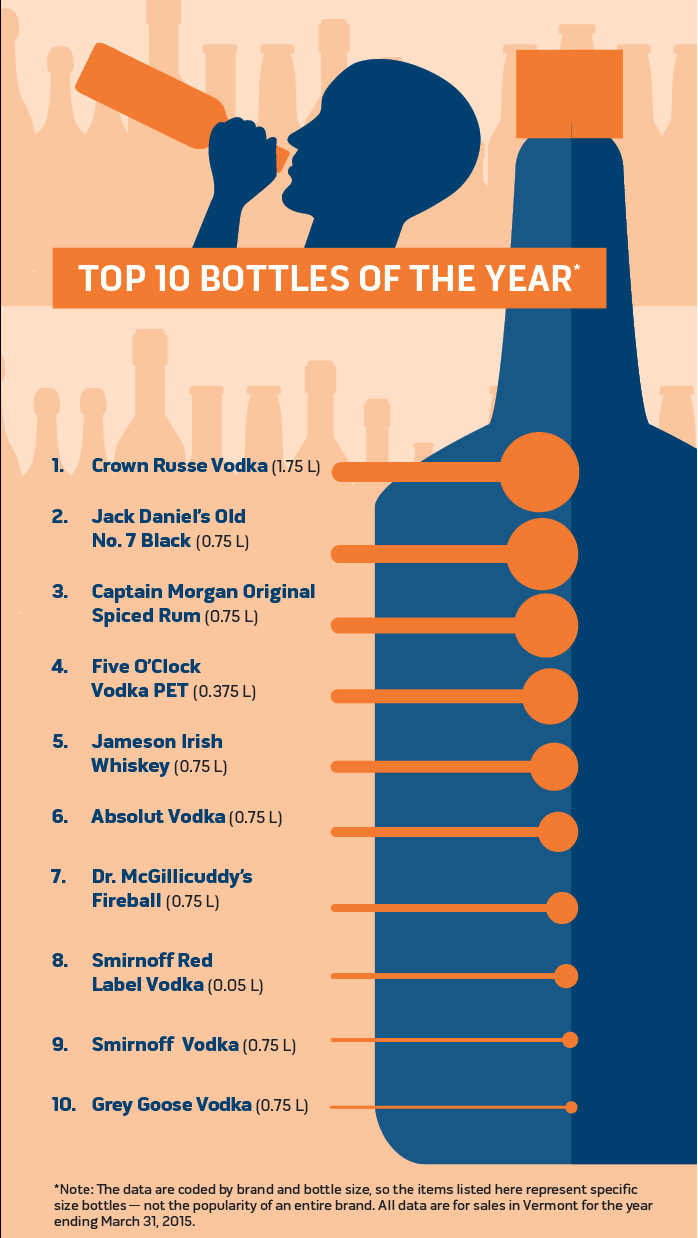

Rising Liquor Sales Make The New Hampshire Vermont Border A Booze Battleground

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Cigarette And Tobacco Taxes For 2022

Scott Pulls Russian Alcohol From Vermont Shelves Vtdigger

Vermont Mulls Pros And Cons Of Privatizing Liquor Sales Business Seven Days Vermont S Independent Voice

Vermont Mulls Pros And Cons Of Privatizing Liquor Sales Business Seven Days Vermont S Independent Voice

Printable Vermont Sales Tax Exemption Certificates

Publications Department Of Taxes

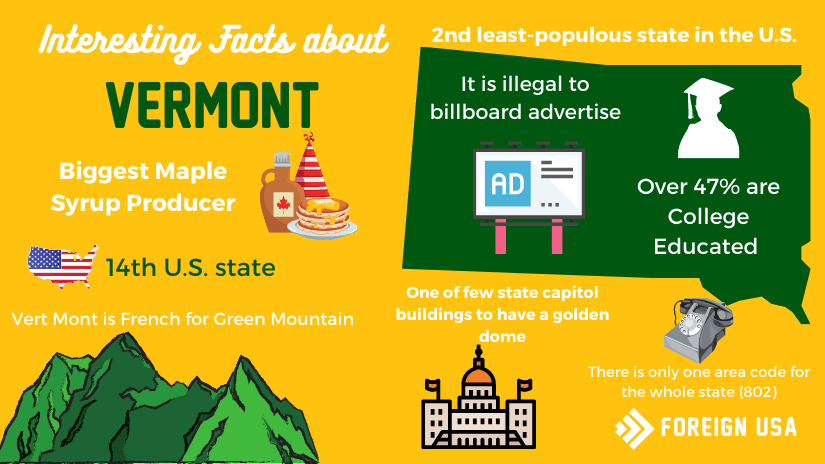

Discover 14 Of The Most Fun And Interesting Facts On Vermont Economic Ones Too

Vermont Income Tax Vt State Tax Calculator Community Tax

Adirondack House House Home House Plans

Which States Have The Lowest Property Taxes Property Tax Usa Facts American History Timeline